Content

Included within the deferral group are such financial entities as annuities, charges, taxes, and income. Public accountants work for companies whose primary service is to provide accounting services, tax accounting, and auditing for other companies. Some examples of public accounting firms are Ernst & Young, Deloitte, and KPMG. Accountants who work for public accounting firms are usually Certified Public Accountants . Students who complete the Fundamentals program will be ready to take advanced-level accounting courses, particularly those included in the Advanced Accounting Certificate Program.

- You will learn how these reports can be used to make sound financial decisions in the next fiscal period.

- There are even some companies that collect revenue in other ways, such as selling assets their business doesn’t need.

- The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel.

- Lenders and investors want a clear idea of your business’ financial state before giving you money.

- It is helpful to have a basic working definition to refer to when attempting to understand some of the higher level activities within the world of finance management.

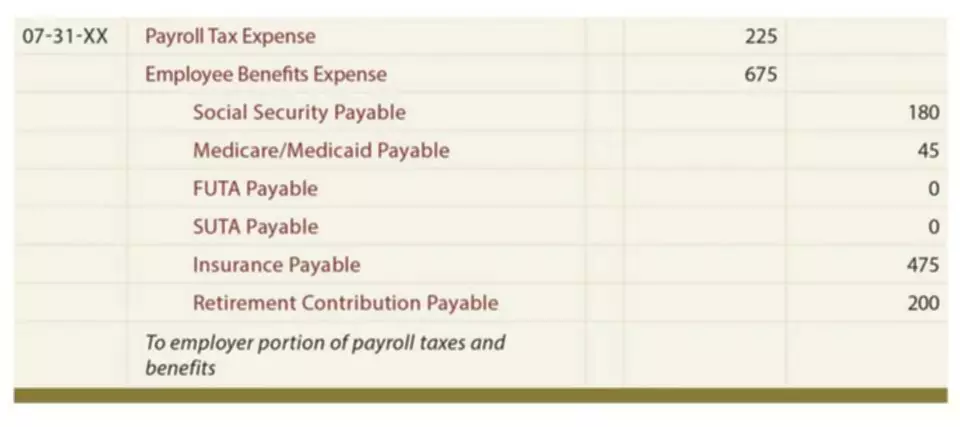

- You can also deduct payroll taxes, which are employment taxes paid on behalf of your employees .

I am currently enrolled in your Accounting Fundamentals II course and look forward to it, as well. The instructional materials required for this course are included in enrollment and will be available online. Please complete the courses in the series two months apart to avoid overlapping. Series bundles are not eligible for partial drops or refunds. Transfers to other open sessions of the same class are available. Please refer to your school for additional details regarding drops, transfers, and refunds on Series bundles.

Bookkeeping Basics You Can’t Afford to Ignore

Not to be confused with your personal debit and credit cards, debits and credits are foundational accounting terms to know. These help accountants gather information from stakeholders and communicate their findings. Knowledge of how the business works is also essential to contextualize financial data. Accountants oversee the financial records for a business and make sure the data is correct.

The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited. Expand your bookkeeping knowledge by brushing up on the most common bookkeeping errors . The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. In fact, this card is so good that our expert even uses it personally.

Owner’s Equity

Making a big investment, like buying a car, can be overwhelming for most of us. Basic knowledge of accounting fundamentals can help you understand how the business works and help you negotiate better deals with confidence. In this lesson, you will prepare for the end of the fiscal period by adjusting your asset account balances to accurately reflect the assets remaining at the end of the year. You will also find out how to journalize and post adjusting and closing entries to bring your company’s General Ledger up to date. A balance sheet denotes an entity’s financial position at a particular point in time. Again, as per the principle of matching, both sides of the balance sheet should always match. On the one hand, we have assets, whereas the other side comprises liabilities and owner’s or stockholder’s equity.

Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans. Accruals will consist of taxes owed including sales tax owed and federal, state, social accounting basics security, and Medicare tax on the employees which are generally paid quarterly. Long-term liabilities have a maturity of greater than one year and include items like mortgage loans.

Use accounting software if:

The overall program goal is to provide students with the basic skills to perform entry-level bookkeeping/accounting functions. Technically, you should be doing it every day, but we all know life can get in the way.

- Understanding basic accounting terms and phrases can be helpful to anyone trying to gain a deeper knowledge of finance and business.

- Look for a bank that has a local branch as well as robust online banking.

- Thus depreciation is deducted from the historical value of the asset.

- Current liabilities are usually accounts payable and accruals.

- Learn more about each principle and the important role they play in effective accounting.

Enter your transactions into this Excel template, and voila! Perfect for small business owners who aren’t ready for full-fledged accounting software. If you wait until the end of the year to reconcile or get your financial transactions in order, you won’t know if you or your bank made a mistake until you’re buried in paperwork at tax time. Regularly organizing and updating your books can help you catch that erroneous overdraft fee today, rather than six months from now, when it’s too late to bring up.